If you have a bad credit, you will be restricted to get credit card that expect you to put down many dollars as a security store. The unstable Total Visa Credit Card offers another option. You can fit the bill for a credit cutoff of $300 without a security store, and your record movement is accounted for to the significant credit agencies.

People with unfortunate credit or practically no record of loan repayment regularly utilize got MasterCard to begin laying out or remaking their credit. With a got charge card, you need to put down a security store, which then goes about as your credit limit.

Total Visa Unsecured Credit Card Highlights:

- For individuals with low/no credit

- Doesn’t need a security store (unstable)

- Doesn’t acquire rewards

- Introductory credit breaking point of $225, with choices to raise after some time

- $89 one-time handling expense for beginning your record

- $75 yearly expense first year; $48 each quite a long time after first year

- $ 0 adjusting charge first year; $75 each year after that

- $29 yearly charge for extra card.

Total Visa Unsecured Credit Card Fees:

- One-Time Fees are $89

- Regular Rate is 34.99%

- Annual Fee is $75 1st year, $48 after that

- Monthly Fee is None 1st year, $6.25 after that

- Grace Period is for 21 days

Accept Total Visa Unsecured Credit Card Mail Offer:

- For this use the web address totalcardvisa.com to visit the Credit Card webpage

- Next at the top right side of the page click on ‘Accept mail offer’ button.

- Add the reservation code and click on ‘Continue’ button.

- center of the page add the reservation code

- Now click on ‘Continue’ button.

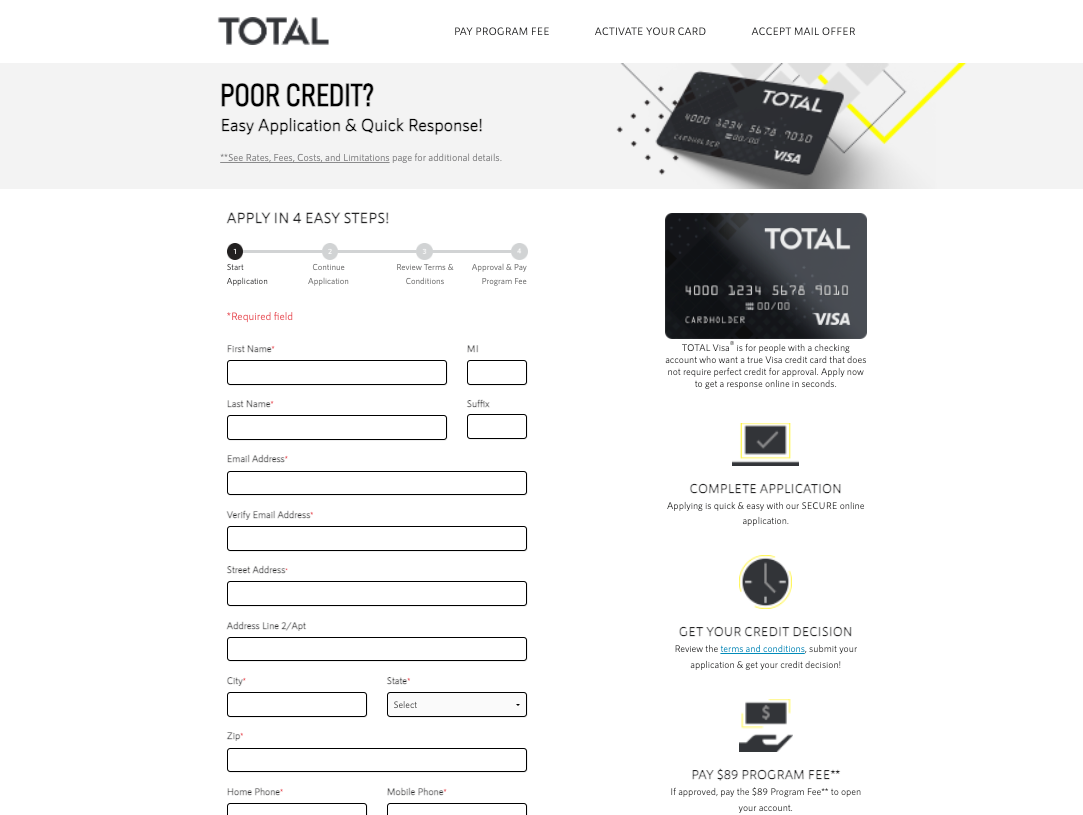

Apply For the Total Visa Unsecured Credit Card:

- Go to the webpage totalcardvisa.com

- Add the information such as, First Name, Middle name, Last Name, Suffix, Email Address, Verify Email Address, Street Address, Address Line 2/Apt, City, State, Zip, Home Phone, Mobile Phone, Do you have an active checking account?, Choose Your Card Design.

- Click on ‘Apply now’ button.

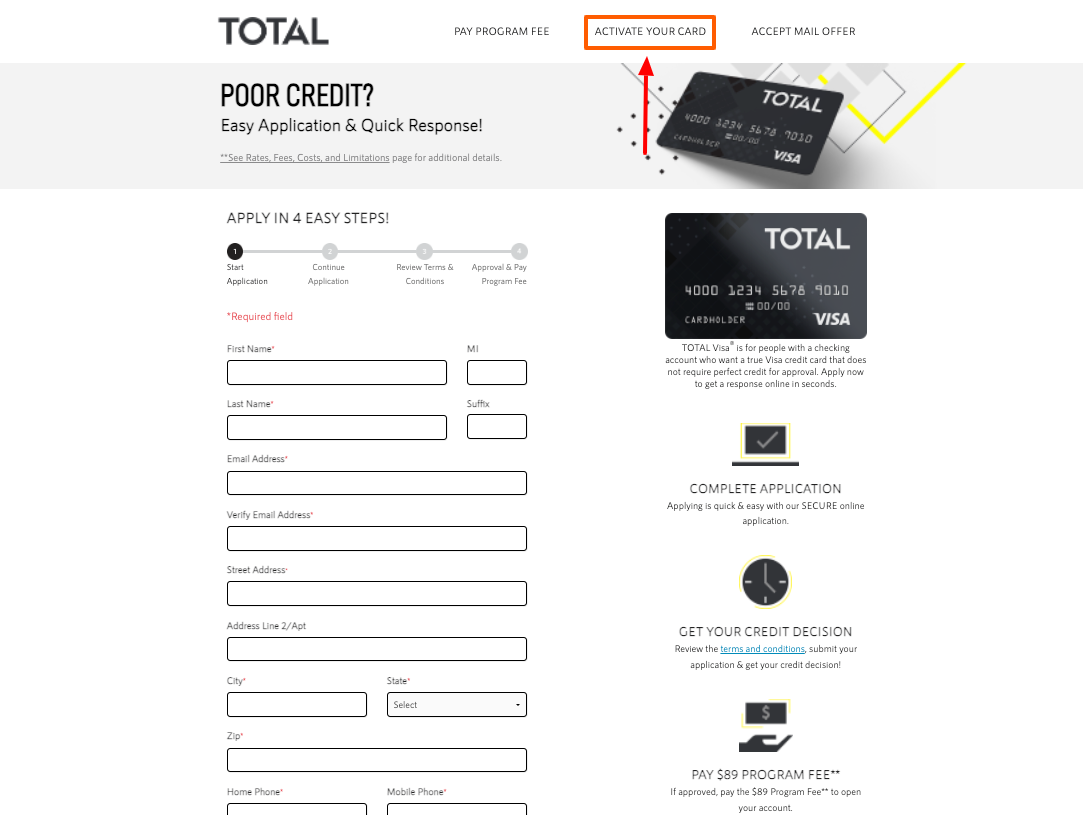

Activate Total Visa Unsecured Credit Card:

- For the activation use the web address totalcardvisa.com

- Next at top right side of the screen click on ‘Activate your card’ button.

- Enter date of birth, application ID or the account associated email click on ‘Submit’ button.

- You have to use the same information for the program payment.

- You will not have to login with the account as just after activation you can use the card in eligible places.

Also Read:

Activate and Login your GreenDot Platinum Card Online

Application process for Amex SimplyCash Plus Business Card Online

Apply and Register your Polaris Credit Card Online

Pay Total Visa Unsecured Credit Card Program Fee:

- You can pay the program fee visit the website totalcardvisa.com

- At top right side of the screen click on ‘Pay program fee’ button.

- Provide the date of birth, application ID or email address or search by the email address.

- Now click on ‘Submit’ button.

Total Visa Unsecured Credit Card Bill Payment by Auto Pay:

- Cardholders can set up Total Visa Card automatic payments through their online account or the Total Card mobile app.

- Call on customer service at 1 (800) 800-2143 also is an option. Once you’re enrolled, Total Card will withdraw the payment amount from your linked bank account on the scheduled date.

Total Visa Unsecured Credit Card Bill Pay by Phone:

- You can make payment and more.

- The Total Visa customer service phone number is (877) 480-6988. You can use this number to check your account balance, make a payment, or for other general customer service inquiries.

Total Visa Unsecured Credit Card Bill Pay by Mail Address:

- Post the mail payment to Total VISA. P.O. Box 84930. Sioux Falls, SD 57118-4930.

- At the paying Total Visa bills by mail, be sure to submit either a check or money order for the payment amount. Total Card does not accept cash.

- Add your credit card number on your payment to avoid any processing delays.

- You have to allow enough time for Total Card to receive your payment on or before the due date, or it will be considered late.

- Send your payment via overnight mail, if required.

Frequently Asked Questions on Total Visa Unsecured Credit Card:

- Is Total Credit Card Legit?

The Total Visa Card is a costly unstable MasterCard for individuals with awful credit. The Total Visa Card’s credit limit is 0+ to begin, and its customary APR is 34.99% two times however much the normal got MasterCard charges.

- What Are The Easiest Unsecured Credit Cards To Get?

Fingerhut Credit Account. Rewards: Credit One Bank Platinum Visa Small Business: Capital One Spark Classic.

- Is Total Visa A Secured Credit Card?

The Total Visa Credit Card is a standard unstable card gave by The Bank of Missouri that is intended for candidates who battle to get endorsed for credit. Rather than paying a refundable security store, as you would with a got card, you pay a few expenses that are not refundable.

Total Visa Unsecured Credit Card Customer Information:

For more help call on (877) 526-5799.

Reference Link: