The Citi Simplicity card is no-nonsense, no yearly charge card that is best used for balance moves during the early on 0% APR time frame. The card doesn’t offer a prizes program, so purchasers searching for approaches to procure prizes should look somewhere else. One disadvantage of this card is its total exchange charge of either $5 or 3% of the measure of each move, whichever is more prominent.

For purchasers searching for a fundamental obligation the executive’s card, the Citi Simplicity Card’s generally long starting 0% APR period is an appealing justification thought. Rather than getting trapped in an interminable pattern of least installments and interest charges, a card like Citi Simplicity could assist with lightening the pressure of obligation amassing.

Citi Simplicity Promotional Mailing Notes:

- The greeting code can be found in the upper right-hand corner of the mailing offer

- The individuals who don’t have a welcome code can in any case apply at the authority Citi Simplicity Card Application Page

- The application will take around 3 to 5 minutes to finish

- Candidates with the greeting number are very prone to be endorsed as they have been pre-screened

- The candidate should likewise give their name, address, telephone number, email address, and consent to a credit check

Citi Simplicity Credit Card Highlights:

- 0% Intro APR for a long time from date of record opening on buys and 0% Intro APR for quite some time from date of first exchange on balance moves

- All special equilibrium moves MUST be finished in the span of 4 months of opening the Citi Simplicity account

- After the 0% APR Intro Promotion has slipped by individuals will be charged 15.49% to 25.49% on balance moved forthcoming using a credit card value

- No yearly expense

- Surplus Transfer Fee is either $5 or 5% of how much each charge card balance move, whichever is more prominent

- Loan Fee is either $10 or 5% of how much each loan, whichever is more prominent

- Citi Simplicity

Citi Simplicity Credit Card Rates:

- Regular APR is 14.74% to 24.74%

- Purchase Intro APR is 0% for 18 months on Purchases

- Balance Transfer Intro APR is 0% for 18 months on Balance Transfers

- The annual Fee is $0

- Balance Transfer Fee applies with this offer 3% of each balance transfer; $5 minimum

- Cash Advance is 5% of each cash advance; $10 minimum

- Foreign Purchase Transaction Fee is 3%

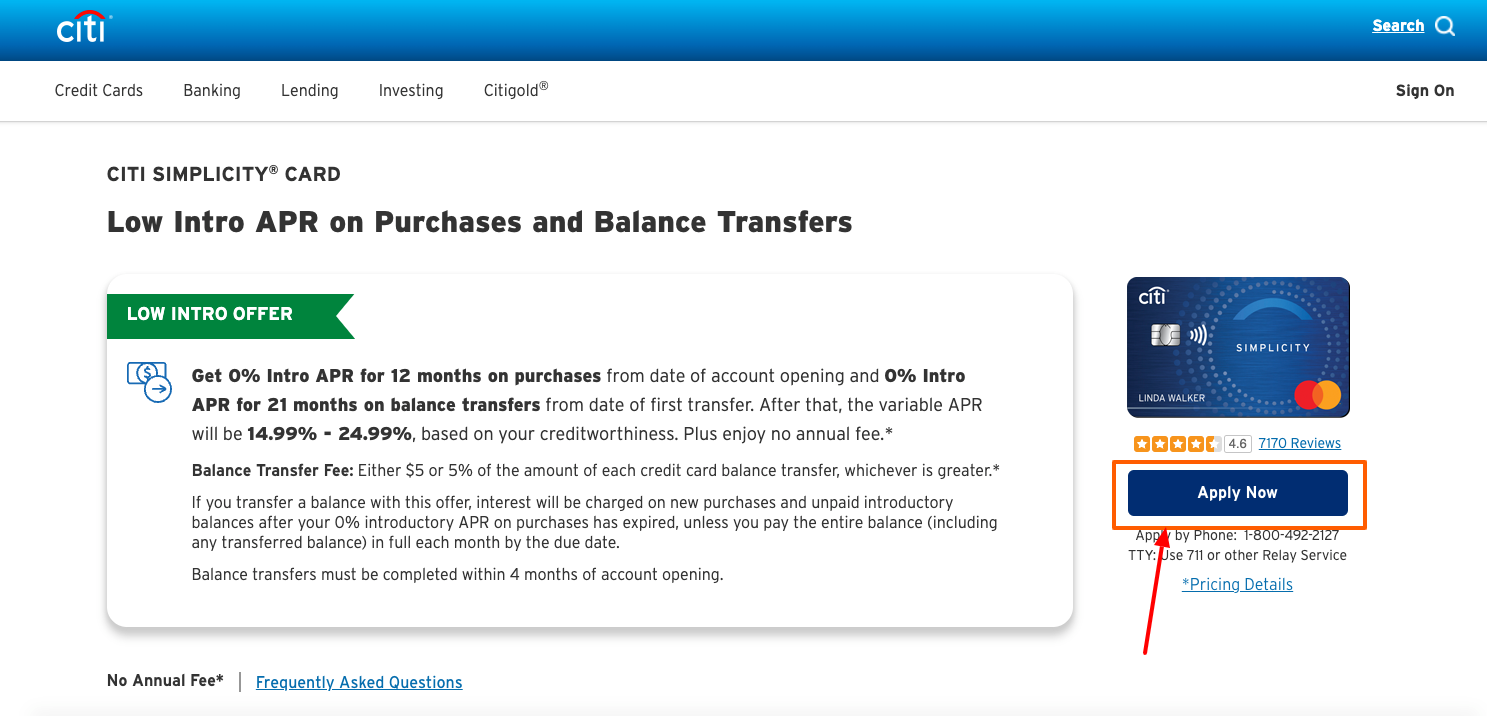

Citi Simplicity Credit Card Application Process:

- Go to the Citi Simplicity Credit Card portal home page. The URL for the website is citi.com/credit-cards/citi-simplicity-credit-card

- Then click on Apply now button on the left side of the page.

- After that fil up the application form and click Apply and Submit button.

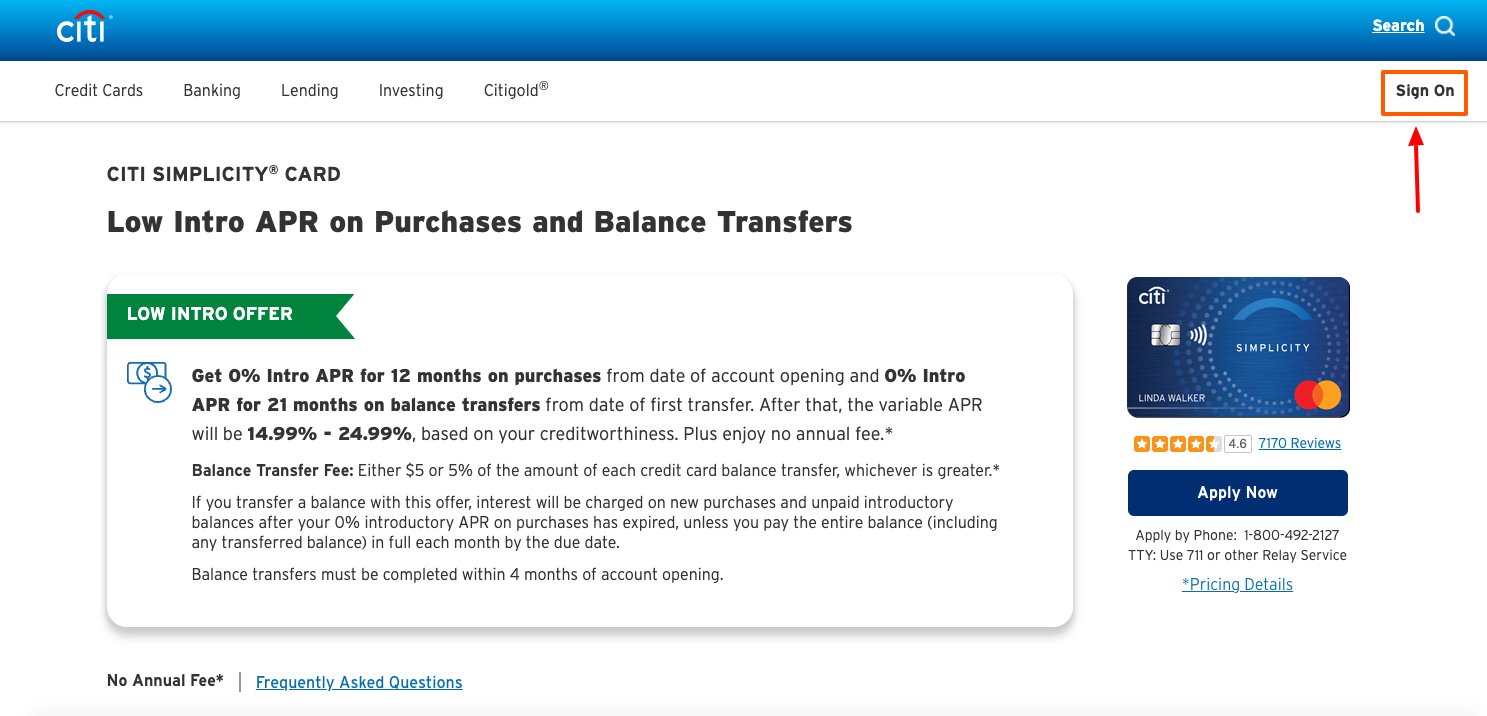

Citi Simplicity Credit Card Login Guide:

- Type the URL citi.com/credit-cards/citi-simplicity-credit-card

- Next at top right side of the page click on ‘Sign on’ button.

- Add the user ID, password.

- Now click on Sign on’ button.

Also Read:

BP Gas Card Login Guide at mybpcreditcard.com

Application process for Total Visa Card Online

Application process for Amex SimplyCash Plus Business Card Online

Recover Citi Simplicity Credit Card Login Details:

- To reset the login information visit the webpage citi.com/credit-cards/citi-simplicity-credit-card

- Then click on the Sign-On button.

- Click on ‘Forgot user ID’ button under the login spaces.

- Select the action you want and proceed with the page instructions.

- For password recovery you need to follow the page prompts.

Register for Citi Simplicity Credit Card Account:

- Go to the portal by using the URL citi.com/credit-cards/citi-simplicity-credit-card

- After click on the Sign On button, click on ‘Register’ button.

- Next choose from the card, bank account number, and paycheck protection program. Now follow the page instructions.

Citi Simplicity Credit Card Activation:

- For this use the web address to visit the Citibank Simplicity Credit Card webpage citi.com/credit-cards/citi-simplicity-credit-card

- In the login section click on the ‘Activate’ button.

- Add your card number now hit on ‘Continue’ button.

Citi Simplicity Credit Card Bill Pay by Phone:

- To pay by phone you have to call on the toll-free number 1 (800) 950-5114.

- You have to follow the automated prompts after connecting the call.

Citi Simplicity Credit Card Bill Pay by Mail:

- For mail payment you have to send the cash or check to, P.O. Box 9001037, Louisville, KY 40290-1037.

- Express or Overnight Payments: 6716 Grade Lane Building 9, Suite 910 Louisville, KY 40213.

Citi Simplicity Credit Card Payment Guide:

- For the auto, payment go to the web address citi.com/credit-cards/citi-simplicity-credit-card

- You have to log in with the online account and set the payment.

Citi Simplicity Credit Card Bill Pay in Person:

- Visit the Citibank Simplicity Credit Card portal. The web address for the portal is citi.com/credit-cards/citi-simplicity-credit-card

- At top right section of the page click on ‘ATM/Branch’ button.

- Next enter your location click on search button.

- Or you can check the already suggested places and the map.

Frequently Asked Questions on Citi Simplicity Credit Card:

- What Credit Score Do You Need For Citi Simplicity?

Your Citi Simplicity endorsement chances are most noteworthy when you have great or better credit. Great acknowledge is regularly characterized as a score of 660 to 719 yet your smartest option is to apply with a score of 700+. A few clients report endorsement with scores as low as 660 and dissents with scores as high as 720.

- How to Pay My Citibank Credit Card Bill?

You can cover your Citibank credit bill on the web, where you can make a one-time installment or set up a month to month programmed installment. You can call 1 (800) 950-5114 to pay by telephone, or you can send your installment by standard mail.

- Does Citibank Have An Annual Fee?

Keep it basic with no late charges, no yearly expense, and their least early on APR. Set aside time and cash with Citi. Buy Rate: 0% Intro APR on buys for quite a long time; from that point onward, the variable APR will be 16.24% to 26.24%, in light of your financial soundness.

Citi Simplicity Credit Card Customer Support:

For more support call on the toll-free number 1-800-347-4934.

Reference Link:

citi.com/credit-cards/citi-simplicity-credit-card